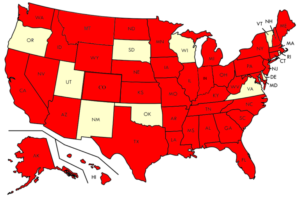

The Office of the Inspector General (OIG) issued a Special Advisory Bulletin in May 2013, which states that providers can “avoid potential Civil Monetary Penalty (CMP) liability” simply by checking the List of Excluded Individuals and Entities (LEIE) to “determine the exclusion status of current employees and contractors.” This past fall, September – November 2014, OIG collected $1.54 Million in Civil Money Penalties (CMPs) in cases involving the employment of persons who have been “excluded” from Medicare. These providers were held liable because they “knew or should have known” that an employee or contractor was excluded from participation in the Federal health care programs. The “knew or should have known” standard arises from the same 2013 OIG Special Advisory Bulletin. OIG states that because the LEIE is updated monthly, OIG recommends that providers check their employees and vendors against the LEIE and SAM monthly in order to avoid CMP liability. The CMPs a provider may face for employing or contracting with an excluded individual or entity include liabilities of $10,000 for each item or service furnished directly or indirectly by an excluded individual, in addition to an assessment of up to three times the total damages, and exclusion from participation in the Federal health care programs. In addition to the federal lists, forty-one states now have their own state exclusion list.

These states require, at a minimum, that providers check their employees and contractors against their state exclusion list in addition to the LEIE as a requirement to participate in Medicaid and other state health care programs like SCHIP. State mandates to search are hidden in a variety of documents such as Medicaid Provider Applications and Agreements, Disclosure of Ownership Interest, the State Code, or even the State’s Excluded Provider List.

These states require, at a minimum, that providers check their employees and contractors against their state exclusion list in addition to the LEIE as a requirement to participate in Medicaid and other state health care programs like SCHIP. State mandates to search are hidden in a variety of documents such as Medicaid Provider Applications and Agreements, Disclosure of Ownership Interest, the State Code, or even the State’s Excluded Provider List.

At Exclusion Screening, LLCSM, we recommend screening your employees and contractors against not only the federal lists and your state exclusion list but every available state exclusion list. The reason we recommend screening your employees against every available federal and state exclusion list is simple. Do you want a person another state has determined is not permitted to bill to their Medicaid or SCHIP program working for your practice? A majority of individuals, at least according to the LEIE, are excluded because his or her license was revoked. Other reasons include felony and misdemeanor convictions for committing health care fraud or for controlled substance offenses.

As of December 2014, 26,178 individuals, or nearly half of the total individuals and entities excluded from participation in the Federal health care programs on the LEIE, were excluded due to a license revocation. An immediate concern following this statistic is that, according to Deputy Inspector General for Investigations Gary Cantrell, not all state licensing boards provide information regarding adverse action taken against providers to OIG. Cantrell reported to the House Subcommittee on Oversight and Investigations within the Committee on Energy and Commerce, that States are not required to provide this information by statute leaving the OIG with incomplete exclusion information.

Furthermore, under ACA Section 6501, all states are required to deny or terminate the enrollment of any provider that is terminated “for cause” by Medicare or another State’s Medicaid or SCHIP program. While the parameters of this new mandate are not yet flushed out, we believe that it is good practice to stay ahead of OIG when it comes to exclusions. Under an ACA sister provision, 6401(b)(2), the Centers for Medicare and Medicaid Services (CMS) was required to create a national database where State agencies could share and access information about individuals and entities that were terminated from the Medicare, Medicaid, or SCHIP programs. CMS created the Medicaid and Children’s Health Insurance Program State Information Sharing System (MCSIS) to make this information available to all State Medicaid agencies so that other states could identify providers that needed to be terminated.

Even though CMS had the authority to require states to submit this information, it only asked states to comply; CMS’s failure to make reporting mandatory resulted in a very deficient database with only 33 states submitting information, most of which was incomplete. After two years of insufficient reporting, CMS discontinued the MCSIS database. It plans to create a new private database, but CMS has not provided a proposed completion date for this new OnePI system or stated whether it would share information with the OIG-LEIE.

Additionally, some states have imposed their own strict requirements on providers. Louisiana providers are required to check the LEIE, SAM, and the Louisiana Department of Health and Hospital Adverse Actions website upon hire and monthly thereafter for all employees and or subcontractors. Louisiana providers are required to maintain proof in their records that these monthly checks were done for employees and or subcontractors, which may be evidenced by printing out search results. Providers are required to check all current and previous names including first, middle, maiden, married, or hyphenated names and aliases for all owners, employees, and contractors. If a provider learns an employee or subcontractor is excluded after hiring, the provider must notify the Department of Health and Hospitals within ten working days.

Texas, like Louisiana, requires that before a provider submits a Medicaid enrollment application, “the applicant or re-enrolling provider must conduct an internal review to confirm that neither the applicant nor the re-enrolling provider, any of its employees, owners, managing partners, or contractors, have been excluded from participation” in Medicare, Medicaid, or SCHIP. In addition, Texas requires that an applicant or re-enrolling provider must also not be terminated from participation in another state’s medical assistance program or SCHIP. Texas Medicaid providers are responsible for checking the LEIE monthly and the Texas Medicaid Excluded Provider (HHSC) list upon hiring and periodically thereafter. While Texas does not define periodically, it does remind providers that they are liable for all fees paid to them by Texas Medicaid for services provided by excluded individuals and “strongly recommend that providers conduct frequent period checks of the HHSC exclusion list.” The list is updated weekly.

Ohio also has a unique set of requirements. Ohio Medicaid providers must, according to the Medicaid Provider Agreement, certify that he or she has no employment, consulting, or any other arrangement with excluded individuals or entities. Managed Care Programs must, at a minimum on a monthly basis, search for excluded providers on the LEIE, the Ohio Department of Job and Family Services (ODJFS) Excluded Provider Page, and the applicable discipline pages of state boards that license providers. Ohio providers are also required to search the SAM, the Ohio Department of Developmental Disabilities Abuser Registry, and the Ohio Auditor of State.

In addition to various state requirements, private healthcare companies also have begun including exclusion screening requirements. Aetna, for example, requires that all health care professionals verify that all employees and “downstream entities that perform administrative or health care services to Aetna’s Medicare Plans” are not excluded on the LEIE or SAM. If an Aetna provider discovers it has employed or contracted with an excluded provider, then he or she must immediately remove this individual or entity from Aetna-related work and immediately notify Aetna. Humana has nearly identical provisions for its physicians, hospitals, and other health care providers.

Screening employees for exclusions has morphed from an easy compliance responsibility to an overbearing obligation. “Knew or should have known” is an easily manipulated standard. Should you have known that another state excluded one of your employees or contractors? If OIG thinks so, you will be liable for Civil Monetary Penalties of up to $10,000 for each item or service furnished directly or indirectly by the excluded individual or entity, an assessment of up to three times the total damages, and exclusion from participation in the Federal health care programs. OIG has ramped up its exclusion enforcement evidenced by CMP liabilities resulting from self-disclosures and investigations totaling 6.07 million dollars in 2014 as compared to previous years with average CMP liabilities of around $3 million.

The risks of not screening your employees against every state exclusion list significantly outweigh the costs of screening, especially when Exclusion Screening, LLCSM is able to efficiently and effectively screen your employees and vendors against all the 41 state exclusion lists at a very reasonable cost to providers.

Call 1-800-294-0952 or fill out the form below today to discuss your exclusion screening needs and for a free assessment.