Exclusions and debarments are powerful administrative sanctions imposed by Federal and State agencies. They are intended to protect their programs and the beneficiaries they serve by barring the participation of individuals and entities who pose risks to them. Sanctioned parties are placed on lists by the agencies that impose them, and providers that employ or contract with entities on those lists risk both overpayment and civil money penalty liability.

The Office of Inspector General’s “List of Excluded Individuals and Entities” (LEIE), the General Service Administration’s Suspension and Debarment List (GSA/SAM), and State Exclusion Lists are the sanction lists have the greatest impact on healthcare providers. The focus of this article is to help providers understand what they represent, the differences between them, and how to determine their screening obligations with respect to each.

I. The List of Excluded Individuals and Entities – or “LEIE”

A. What is the “List of Excluded Individuals/Entities” – or LEIE?

The Office of Inspector General for the Department of Health and Human Services (HHS/OIG, or OIG) has the authority to exclude individuals and entities from participating in federal health care programs.[1] The List of Excluded Individuals/Entities (LEIE) identifies all persons and legal entities currently under an exclusion sanction, and providers must ensure that they don’t employ or contract with anyone on the list.

The LEIE currently has 78,927 entries.[2] It is maintained and updated monthly by the OIG, and it can be accessed on the OIG’s website. The LEIE can be searched directly on the website or downloaded in its entirety from the site in excel format and it contains sufficient information for providers to determine if someone they want to employ or contract with is excluded. For example, it includes dates of birth for individuals, the authority or basis for the exclusion, the date the exclusion was imposed, the state where the excluded individual resided at the time of the exclusion and the “provider type.” The list also may contain NPI and licensing numbers for. When a search reveals two names that are the same or very close, matches can only be verified individually on the website by Social Security Number.

B. What is the Effect of an Exclusion?

All federal health care programs (Medicare, Medicaid, TRICARE, etc.) are prohibited from paying for any item or service furnished directly or indirectly by an excluded individual or entity.[3] The payment prohibition extends to all services, not just those billed directly, and to all methods of Federal program reimbursement. It includes, for example, management and administrative services, support and nursing services and claims processing, regardless of whether they are itemized claims, or included in a cost reports, capitated payment or other bundled payment.[4]

It is an absolute ban on all federal program compensation such that providers who employ or contract with an excluded party risk significant financial consequences. Reimbursements made in violation of the payment prohibition are overpayments which must be repaid, and civil money penalties for employing or contracting with excluded parties can also be imposed.[5] It is also noted that under the ACA, unpaid overpayments can result in false claims act liability.

C. How Does Someone End up on the LEIE? What Types of OIG Exclusions Are there?

There are two types of exclusions: Mandatory and Permissive. Mandatory exclusions are based on felony convictions[6] and permissive exclusions can be imposed for a wider range of conduct.[7] However, most exclusions arise out of criminal convictions and/or licensing disciplinary proceedings related to fraud, drugs, or patient abuse, and regardless of the basis of the exclusion.

The administrative process the OIG must follow to impose an exclusion is somewhat different for mandatory and permissive exclusions.[8] However, once an exclusion is imposed it is final and appeals are limited to the length of the exclusion and not the exclusion itself. It is also noted that after an exclusion is imposed, the only difference in the effect of mandatory and permissive exclusions are their length and the reinstatement process.

D. Which Providers Have to Screen the LEIE?

Providers that participate in any federal healthcare programs must ensure that none their employees or contractors excluded. The only way to fulfill this obligation is to affirmatively check (or “screen”) the LEIE to see if their names are on that list. While caution dictates casting a wide net in deciding who to include on the list, the OIG has recognized that choosing who screen can sometimes be difficult (particularly with contractors), and it has stated that the risk of “CMP liability is greatest for those persons that provide items or services integral to the provision of patient care.”[9] Providers that don’t participate in federal programs should also strongly consider screening because most private payers include contractual clauses that state they will not pay for items or services provided by excluded parties.

Providers should screen prior to employment or to the initiation of a business relationship and monthly thereafter. The necessity of monthly screening is often questioned, but it not only makes sense since a person’s exclusion status is always subject to change,[10] but the requirement for monthly screening is almost universal in the payer universe. All State Medicaid Programs require monthly screening,[11] Medicare Advantage Plans Require it,[12] and the OIG has unequivocally expressed its view that monthly screening “best minimizes potential overpayment and CMP liability.”[13]

II. The GSA/SAM: The Suspension and Debarment List of the General Services Administration

A. What is the GSA/SAM Suspension and Debarment List?

The General Services Administration (GSA) oversees federal government contracting and procurement activities. This includes the acquisition process, building and acquiring office space, property management and so on. The System for Award Management (SAM) is a component of the GSA that was created to coordinate and facilitate the procurement and contracting process by, among other things, centralizing the registration process for those seeking to do business with the government and collecting and disseminating information to those seeking to participate in the process. The SAM also hosts a Suspension and Debarment List that identifies individuals who are not allowed to contract with the government or conduct business as an agent or representative of another contractor. Since the list is hosted by the SAM, which is a component of the GSA, it has come to be generally known as the “GSA/SAM” or the “GSA SAM.”

B. What are Suspensions and Debarments? How do they Differ from OIG Exclusions?

Suspensions and debarments focus on protecting the government from contracting or doing business with irresponsible contractors. They can be imposed by any agency for actions connected to a contract (over 50 have contributed to the GSA/SAM), and the principal consequence is that debarred or suspended entities cannot contract directly with the government or act as an agent or representative of other contractors. Exclusions, on the other hand, focus on protecting healthcare beneficiaries as well as healthcare programs. As such, they ban extends beyond contracting and includes any participation that would lead directly or indirectly to claims.

Another difference is that the LEIE only lists exclusions and all exclusions have the same impact,[14] whereas debarments and suspensions are different sanctions imposed for different reasons. Debarments are final actions that are imposed after an investigation or legal proceedings have concluded that are generally capped at three years and suspensions are temporary measures imposed during an investigation that last a year of less. It is also noted that the GSA/SAM lists additional sanctions beyond those.[15]

What are the causes for Suspensions and Debarments?

Not surprisingly, the main causes for these sanctions are similar to the reasons for exclusions. They include fraud, embezzlement, theft, forgery, falsification or destruction of records, bribery, making false statements, tax evasion, receiving stolen property, and unfair trade practices. The willful failure to perform, violations of the Drug-Free Workplace Act and delinquent Federal taxes of more than $3,000 may also be a basis.

Does the GSA/SAM Effect Health Care Providers? Do We Have to Screen it?

Although the GSA/SAM was intended to impact contracting and procurement, the requirement to screen it in tandem with the LEIE has become almost universal. State Medicaid programs require that it be screened, Medicaid Managed Care and Medicare Advantage Plans require that it be screened, CMS requires it as part of its oversight responsibilities of the Medicaid program, and the OIG has been adding the GSA/SAM to lists that must be screened in their Corporate Compliance Plans.[16]

However, since someone can be on the GSA/SAM for reasons that are entirely unrelated to healthcare or fraud and abuse of any kind, beyond the obligation to screen — the consequences of a provider discovering that an employee or contractor is on the GSA/SAM is not entirely clear. That said, such a listing is beyond the scope of this article, but providers should be aware of the possibility and consult with their counsel as to how to proceed in such a circumstance.

III. State Medicaid Exclusion Lists

A. Why Do States Maintain Separate Exclusion Lists?[17]

State Medicaid programs, like Medicare, are prohibited from paying for items or services furnished by excluded parties.[18] States also have the authority to terminate, or exclude, providers from their programs for any reason permissible under state law,[19] or for any reason the OIG could impose an exclusion under federal law.[20] When States exclude or terminate providers based on federal law, they are required to inform the OIG so that it each can evaluate whether a federal exclusion is also warranted. They are also required to notify their sister States so that they may also consider termination or imposing an exclusion.[21]

Although States are permitted to rely on the LEIE for identifying parties, most states maintain their own separate sanction lists to supplement the LEIE.[22] A powerful reason for States to maintain separate exclusion lists is that they provide a central registry for the State to list, and for providers to find, parties that have been excluded or terminated from a Medicaid program based solely on state law. Sanctions based on State law, but not federal law, will not be included on the LEIE- so how could providers find them? It is also the best way to publish and ensure compliance with exclusions or terminations based on federal law. It can several months for the OIG to process and list a State imposed exclusion, and during the time between the State action and the time the OIG included the person on the LEIE, providers couldn’t know about the exclusion.

States lists are also a convenient way to have a central registry of all sanctions, non-healthcare as well as those relating to healthcare, imposed by its agencies. For example, a State might want also want to exclude or debar a party for failing to pay State taxes, or for a variety of other reasons, that would not be valid bases for federal exclusions, and a central list is might be the best solution for making the list public. Many States use their lists for just this purpose.

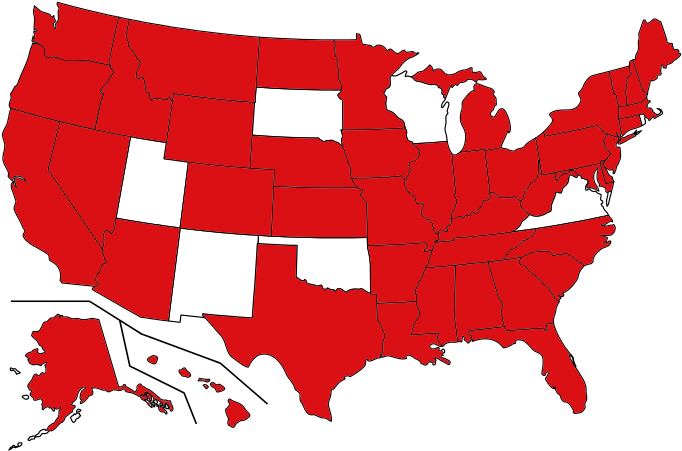

B. Which States Don’t Separate Exclusion Lists?

The only States that do not maintain separate exclusion lists are New Mexico, Oklahoma, Rhode Island, South Dakota, Utah and Wisconsin. Providers should be aware, however, they these states may have separate agency sanction lists or other centralized lists that they need to screen.

C. Do all State Lists Have the Same Data? Are they all in the Same Format?

NO and NO. State lists vary in almost every detail. They have a variety of different names,[23] are published in different formats, have different data fields and have different processes for confirming sanctions. There is also a wide disparity in their size and in the sanctions they post. Some state lists are quite large, but several States have lists of 150 or less.

D. What are the Provider Screening Obligations with Respect to State Lists?

Providers should carefully review the requirements in their State applicable to their payers and their practice as they seek to answer this question. They might also want to consider seeking advice from healthcare counsel on the issue. With that in mind, it is hoped that providers will find the following information to be helpful.

The starting point for screening State lists is simple: If a provider is providing services in any federal or state health care programs in a State that has an exclusion list, they will always be required to screen that state list in addition to the LEIE and the GSA. Beyond this requirement, however, providers should be aware that a number of States also have “implied screening obligations.” By an implied screening obligation, we mean a requirement that can only be fulfilled by screening additional States but is not specifically stated as such.

Louisiana’s provider application, for example, requires applicants to “Certify that no employee has ever been “suspended or excluded from Medicare, Medicaid or other Health Care Program in any state” or ever been suspended or excluded from Medicare, Medicaid or other Health Care Programs.” New Jersey’s provider agreement implies a similar obligation by requiring the disclosure of “any employee that has “ever been the subject of any suspension, debarment, disqualification or recovery action involving Medicaid… Medicare…, any other federally or state-funded health care program, … in this state or any other jurisdiction.” State law may also contain implied screening obligations. In Texas, a “Provider must conduct an “internal review to confirm that neither the applicant or the re-enrolling provider, nor any of its employees, owners, managing partners, or contractors (as applicable), have been excluded from participation in a program under Title XVIII, XIX, or XXI of the Social Security Act and certify that it was performed.”[24]

Though none of these requirements are the same, and none specifically state providers must screen all State lists – could any of them be met without screening all State Lists? Providers should be aware that their State may have similar implied screening obligations, and a discussion with health care counsel about their potential implications would be advisable.

IV. A Final Note on Screening State Lists

Regardless of whether there are direct or implied screening obligations, compliance and common sense suggest that the best course of action for providers would be to screen every State List. After all, virtually every significant risk to health care providers is related to the people they employ or the do business with – and at the core of every sanction is that the determination that an individual or entity poses and unacceptable risk to either people and/or programs. It is true that those determinations may be wrong from time to time, but why take that risk?

Paul Weidenfeld is a former federal healthcare fraud prosecutor and Department of Justice National Health Care Fraud Coordinator. His principal area of practice is healthcare fraud and abuse and the Federal False Claims Act, and he has represented providers and individuals in healthcare matters since leaving government in 2006. Mr. Weidenfeld also has an extensive litigation background that includes numerous trials and appeals and appearances before the United States Supreme Court, the Federal 5th Circuit Court of Appeals, and the Louisiana Supreme Court.

[1] The Department of Health and Human (HHS) exclusion authority pursuant under SSA Sections 1128 and 1156 was delegated to its Office of Inspector General. 53 Fed. Reg. 12,993 (April 20, 1988)).

[2] As of February, 2024. Updates include new exclusions and removes those that have been reinstated.

[3] Federal health care programs are broadly defined to include “any plan or program” that receives funds government funds either directly or indirectly. 42 C.F.R. 1001.1901(b); 42 C.F.R. § 1001.10.

[4] See 42 C.F.R. § 1001.10. See 2013 Special Advisory on the Effect of Exclusions, at pgs. 6.and 7). 11-12, 16.v

[5] Currently, the OIG can impose civil money penalties up to $22,427 for each claim that violates the payment prohibition. This amount increases each year.

[6] Primarily healthcare fraud, neglect or abuse, and manufacture or distribution of drugs.

[7] The range is wide, but the vast majority of permissive exclusions are based on professional licensing disciplinary actions.

[8] It is governed by 42 CFR sections 1001.2001 through 1001.2007.

[9] See 2013 Special Advisory at 16. The dual focus of patient safety and program integrity was again emphasized in the amendment of CMP rules in 2017. The new 2017 rules are a valuable guide in determining who to screen.

[10] For example, the resolution of pending licensing or criminal matters can readily result in an exclusion.

[11] 42 CFR §455.436(c)(2), § 438.602; and CMS State Medical Director Letters SMDL #08-003 and SMDL #09-001. All States have adopted these requirements and passed them on to providers.

[12] Chapter 9 and 21 Medicare Managed Care and Chapter 21 Prescription Drug Benefit manuals.

[13] (2013 Special Advisory at 15).

[14] Mandatory exclusions will generally last longer than permissive ones, but impact is otherwise the same..

[15] It can also include proposed debarments, declared ineligible actions, and disqualifications imposed in non-procurement actions (such as grants) under the non-procurement common rule.

[16] See, for example, 42 CFR §455.436(c)(2), §438.602; Chapters 9 of the Medicare Managed Care Manual and Chapter 21 Prescription Drug Benefit manuals, and CMS State Medical Director Letters SMDL #08-003 and SMDL #09-001.

[17] Links to all State Lists are included in States With Separate Exclusion Databases

[18] Medicaid will not pay for items or services furnished by, or at the medical direction of, an excluded party. Social Security Act Sections 1902(a)(39) and 1903(i)(2). See also, 42 CFR§1002.1(a)(5).

[19] 42 CFR § 1002.1(a)(3).

[20] 42 CFR § 1002.1(a)(4). Whenever States exclude or terminate providers based on federal law, they are required to inform the OIG. 42 CFR § 1002.3(b). Under the Affordable Care Act, they are also required to notify their fellow States. These notification requirements are in place so the OIG and the States can consider adding the providers to their exclusion lists.

[21] Notification to the OIG is pursuant to 42 CFR § 1002.3(b). Notification to the States is required by 1605 of the Affordable Care Act.

[22] Currently, 43 States plus the District of Columbia maintain separate sanction lists.

[23] The following names (or variations of them) are the ones most commonly found: Excluded Provider (or Provider Exclusion) List; Sanctioned Provider Report or List; Terminated Provider (or Provider Termination) List; Suspended and ineligible list; Adverse Action List; Precluded Provider List.

[24] TAC 352.5(b)(1)

Frequently Asked Questions

Requirements and Regulation for Screening

Who is Required to Screen the LEIE?

Every provider that provides items or services that are reimbursed, in whole or in part, by a federal healthcare program is required to ensure the exclusion status of their employees, vendors and contractors – and the only way to fulfill that obligation is to affirmatively check, or “screen,” the Office of Inspector General’s List of Excluded Individuals/Entities (the LEIE). Federal health care programs are defined broadly so that they include Medicare, Medicaid, CHIPs, TRICARE, and any other programs that receives any federal funding.

Participating providers with private payers are also likely to be required to screen the LEIE regardless of whether or not they accept federal funds! Most participation agreements with private payers include contractual clauses that specifically exclude reimbursement for items or services provided by excluded parties.

Who Should be Screened? Who are Providers Required to Screen?

Providers are responsible to ensure the exclusion statues of all employees, vendors and contractors that provide items or services, directly or indirectly, in whole or in part, that are payable by federal health care programs. This is not limited to direct billers, and examples of services identified by the OIG includes the following: transportation service providers, administrative services, medical equipment suppliers, billers and coders pharmacists, etc. When in doubt as to who should be screened, providers may want to consider that the OIG has stated that civil penalty liability is “greatest for those persons that provide items or services integral to the provision of patient care.”

How Often Should Screening be done?

Providers should screen prior to employment or to the initiation of a business relationship and monthly thereafter. Monthly screening makes sense because a person’s exclusion status is always subject to change. It is required by all Medicare Advantage Plans, all State Medicaid Programs, and all Medicaid Managed Care Organizations. In addition, CMS and the OIG have equivocally expressed its support, and the OIG has linked a failure to screen with overpayment and CMP liability.

Can a provider participate in federal programs once their exclusion period is over? What does an excluded provider have to do to get their name removed from the LEIE?

Excluded parties are not automatically removed from the LEIE or reinstated into the program. Excluded may apply for reinstatement 90 days before the date specified on his, her, or its exclusion notice letter, but the application is not automatically granted. The application must demonstrate that the excluded party not provided services to federal programs during the period of exclusion, and that the party is “fit” to be re-admitted into the program. In addition, if the exclusion was based on a licensing issue, the applicant is must show that the issue with the licensing board has been resolved.

How Does the GSA/SAM Effect Health Care Providers? Do We Have to Screen it?

The requirement to screen the GSA/SAM is most often added by payers and programs to the requirement to screen the LEIE. State Medicaid programs are required to include it in screening obligations; all Medicare Advantage and Medicaid Managed Care Programs require that it be screened; CMS requires it as part of its oversight responsibilities of the Medicaid program; and the OIG now adds GSA/SAM screening in their Corporate Compliance Plans connected to false claims act settlements.